West Virginia Carbon Capture Opportunities

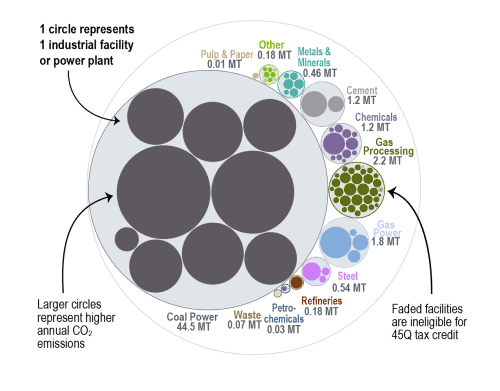

Carbon capture can lower emissions across a variety of sectors present in West Virginia and bring jobs and private investment to the state. Of the 113 industrial and power facilities in the state, 73 are eligible for the 45Q federal tax credit. These 73 facilities emit over 52 million metrics tons of CO2 annually, representing 99 percent of annual CO2 emissions in the state. All nine of West Virginia’s coal power plants, which contribute 85 percent of the state’s total annual CO2 emissions, are 45Q eligible.

The state has been proactive in enacting carbon management legislation and preparing itself to scale carbon management deployment. Recently, the US Environmental Protection Agency (EPA) granted Class VI primacy to West Virginia, meaning the state now has primary enforcement authority over the permitting process for the permanent storage of CO2 in geologic storage wells. It is the fourth state to be granted Class VI primacy alongside North Dakota, Wyoming, and Louisiana.

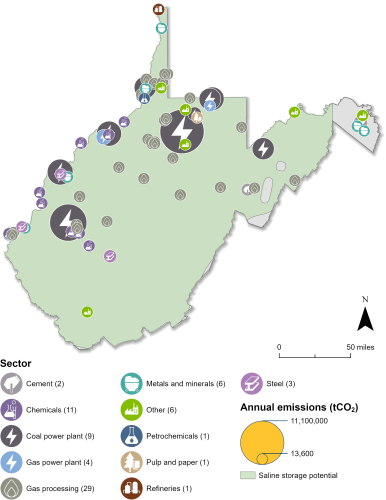

Industrial and Power Facilities in West Virginia

West Virginia has 73 facilities that are eligible for the 45Q tax credit, with the plurality of these being gas processing facilities. However, 85 percent of emissions in the state come from nine coal power plants, all of which are 45Q eligible. The state also has four gas power plants, two cement plants, three steel plants, and a number of other industrial facilities that are 45Q eligible. In total, these 73 facilities emit approximately 52 million metric tons of CO2, representing 99 percent of the state’s total annual CO2 emissions.

Given West Virginia’s recent obtainment of Class VI primacy, it can now permit geologic CO2 storage wells directly through the West Virginia Department of Environmental Protection (WVDEP). WVDEP expects to issue at least three Class VI permits in the state within two years of its Class VI program becoming fully operational.

Beyond capturing and storing its own emissions, West Virginia’s geologic CO2 storage potential could be a significant resource for other states in the region looking to permanently store their CO2.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

In 2024, West Virginia passed legislation (HB 5045, SB 596) to amend West Virginia’s laws and enhance regulatory oversight of underground CO2 storage, extend post-injection care periods, clarify liability transfers, and ensure compliance with federal environmental standards. This legislation laid the groundwork and provided assurances to the EPA about the state’s ability to assume primacy over Class VI wells.

Additionally, West Virginia is involved in federal-level initiatives that support carbon management deployment. West Virginia is part of the US Department of Energy-funded ARCH2 Hydrogen Hub, alongside Pennsylvania and Ohio. This project is a collaboration between private industry, state and local governments, academic and technology institutions, non-profit organizations, and community groups. ARCH2 hopes to leverage the Appalachian region’s resources to facilitate clean hydrogen production, which will include the capture and storage of CO2 emitted during the hydrogen production process.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in West Virginia. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in West Virginia is listed for each industry.

Sources: EPA GHGRP, 2024.

Last updated: February, 2025