Virginia Carbon Capture Opportunities

Carbon management could play a key role in Virginia’s clean energy and industrial economy. Out of the state’s 128 industrial and power facilities, 88 are eligible for the federal 45Q tax credit. Together, these facilities emit nearly 35 million metric tons of carbon dioxide (CO2) annually, which represents 99 percent of Virginia’s total annual CO2 emissions.

Though Virginia has enacted legislation committing to carbon-free energy from solar and wind by 2050, the state has not enacted or introduced legislation to specifically facilitate the deployment of carbon management. However, the Virginia Department of Energy has been involved in several research projects related to CO2 storage, signaling state-level interest in carbon management and the opportunities it could bring.

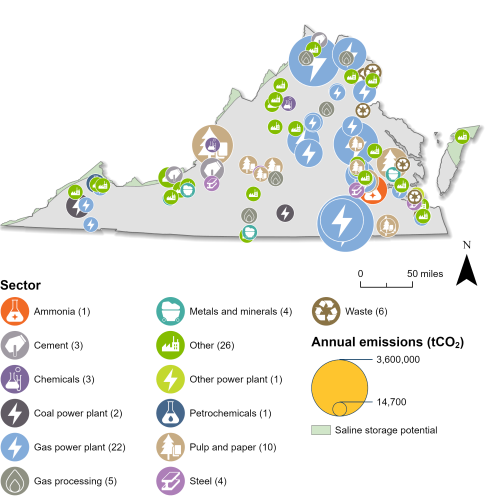

Industrial and Power Facilities in Virginia

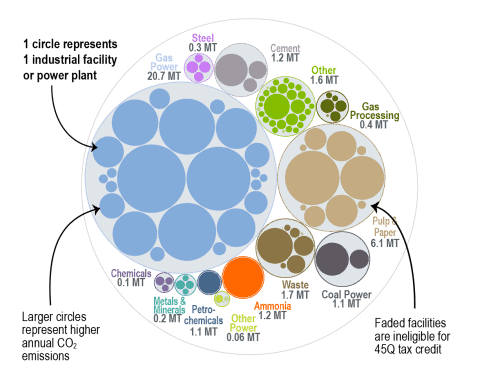

Virginia has 88 facilities that qualify for the 45Q tax credit. Twenty-two of these are gas power plants, which emit over 20 million metric tons of CO2 annually. In addition to the 22 gas power plants, Virginia has 10 pulp and paper plants, six waste facilities, five gas processing plants, four steel plants, two coal power plants, three cement plants, and 36 other facilities that are 45Q-eligible. In total, these 88 facilities emit nearly 35 million metric tons of CO2 annually, representing 99 percent of the state’s total annual emissions.

Beyond carbon capture, Virginia has potential for permanent storage of CO2 in saline geologic formations, both onshore and offshore. Given its proximity to other Mid-Atlantic states with a heavy industry presence, Virginia is also well-positioned to be part of a regional CO2 transport network.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Through the 2020 Virginia Clean Economy Act, the state has committed to 100% carbon-free electricity for state utilities by 2050 at the latest. This legislation sets a timeline for Dominion Energy Virginia and American Electric Power to retire carbon-emitting power plants in the Commonwealth and to develop, acquire, or contract for solar and onshore wind energy capacity.

However, as of February 2025, Virginia has not enacted or introduced specific legislation to facilitate the deployment of carbon management regarding issues like long-term liability of CO2 injection wells and pore space rights.

Though the state has not directly addressed carbon management through legislation, it has signaled interest in exploring carbon management opportunities through research projects with the Virginia Department of Energy. Currently, Virginia Energy and Virginia Tech, funded by the Mining Innovations for Negative Emissions Resource Recovery Program, are developing a carbon mineralization and metal extraction technology to recover energy-relevant elements during carbon mineralization processes. From 2010 to 2011, Virginia Energy collaborated with the United States Geological Survey to conduct a preliminary assessment of the geologic formations in Virginia that might serve as permanent storage formations for CO2. From 2015 to 2019, Virginia Energy conducted a Southeast Offshore Storage Resource Assessment in partnership with Southern States Energy Board and funded by the US Department of Energy.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Virginia. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Virginia is listed for each industry.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Last updated: February, 2025