Utah Carbon Capture Opportunities

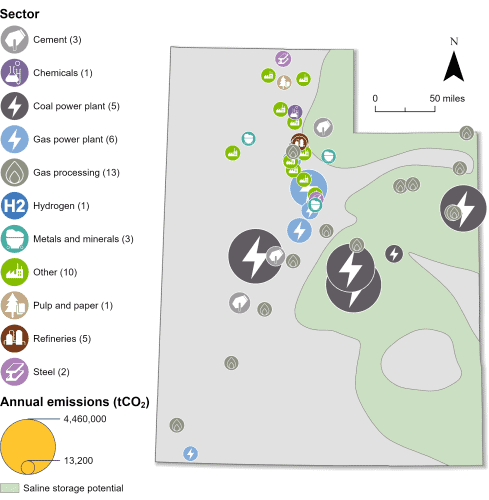

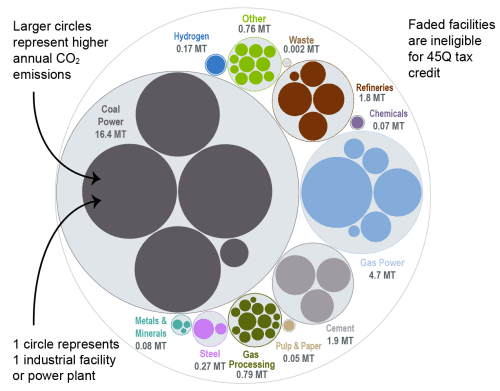

Carbon management can lower emissions across a variety of sectors present in Utah and bring jobs and private investment to the state. Of the 65 industrial and power facilities in the state, 50 are eligible for the 45Q federal tax credit. Utah’s highest emitters are its five coal plants, one of which is scheduled to retire in 2025. Together, all 50 of the state’s 45Q-eiligble facilities emit around 27 million metric tons of carbon dioxide (CO2) annually, representing 99 percent of Utah’s total annual CO2 emissions.

Utah has enacted comprehensive carbon management legislation to address issues like pore space ownership, unitization, and long-term liability. Additionally, project developers in the state can access state-level tax credits to offset project costs, and the state is actively pursuing Class VI Primacy. Given this supportive environment, Utah is well-positioned for further carbon management deployment.

Industrial and Power Facilities in Utah

Utah has 50 facilities that are eligible for the 45Q federal tax credit. Its four coal power plants are the state’s highest emitters, which account for over half of the state’s total annual CO2 emissions. All five plants are 45Q-eligible. Additionally, Utah has 13 gas processing plants, six gas power plants, five refineries, three cement facilities, and 18 other facilities that are 45Q-eligible. In total, these 50 eligible facilities emit around 27 million metric tons of CO2 annually, representing 99 percent of the state’s annual CO2 emissions.

Utah also has the potential to safely store CO2 underground in geologic formations. The Utah Geological Survey (UGS) is exploring this storage potential through federally funded projects, including a CarbonSAFE project in the Uinta Basin with partners at the University of Utah. Because of this potential, Utah submitted a letter of intent to apply for funding under the US Environmental Protection Agency’s (EPA) Underground Injection Control (UIC) Class VI grant program in 2023. This grant program was developed to help states prepare for Class VI primacy, which gives individual states primary permitting authority over their Class VI injection wells.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Utah has laid a strong regulatory foundation for carbon management deployment by enacting comprehensive legislation on issues like pore space ownership, unitization, and long-term liability. Related legislation enacted in recent years also has implications for deployment:

- SB 202 (2008): Specified that carbon management technologies are included in low-carbon electricity standards. Required the state to design regulatory guidelines for carbon capture and storage (CCS). Required that beginning in 2025, at least 20 percent of adjusted electric retail sales come from cost-effective renewable or clean sources, including power generated using carbon capture technology.

- HB 124 (2024): Modified the existing High-Cost Infrastructure Tax Credit to include emissions reduction projects, including projects utilizing CCS technologies.

- HB 452 (2024): Repealed two existing funds and established the “Carbon Dioxide Storage Fund” as a special revenue fund. The fund finances regulatory expenses for storage facilities, including construction, operation, and pre-closure activities. It also funds permitting, inspection, monitoring, investigation, reporting, long-term monitoring, remediation, and repair of storage facilities and injection wells.

- HB 352 (2025): Granted the Utah Board of Oil, Gas, and Mining, along with the Division of Oil, Gas, and Mining, enforcement authority over CO2 injection wells upon receiving primacy from the Environmental Protection Agency. Outlines civil and criminal penalties for violations.

- CR 9 (2025): Sought to establish an interstate compact between Utah, Wyoming, and Idaho to enhance regional energy collaboration, addressing shared challenges related to energy production, grid reliability, and regulatory burdens. As part of this effort, the compact would support critical infrastructure projects, including carbon capture systems.

In addition to legislation, former Governor Gary Herbert supported carbon management in 2018 by joining the Governors’ Partnership for Carbon Capture, a bipartisan group of governors that provides leadership, focus, and a stronger state voice for carbon management policy and technology deployment.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Utah. The darker bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Utah is listed for each industry in million metric tons.

Source: EPA GHGRP, 2024.

Last updated: June 2025