Texas Carbon Capture Opportunities

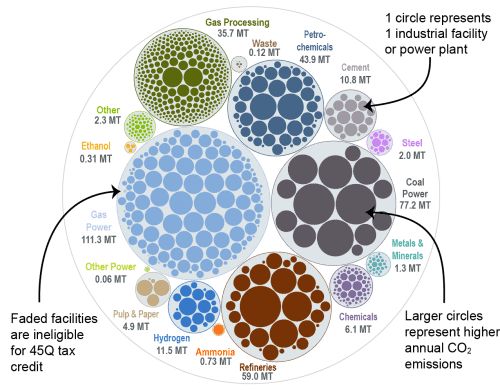

Carbon management can help maintain Texas’ position as an energy leader and bring jobs and private investment to the state. Of the state’s 850 power and industrial facilities, 693 qualify for the 45Q federal tax credit. The highest proportion of facilities are natural gas plants, at 116. Several other key industries, including hydrogen, cement, steel, and chemicals each have over a dozen eligible facilities in the state.

With a supportive tax structure and policy environment, significant interest from project developers, and abundant geologic storage potential, Texas is well-positioned to encourage further carbon management deployment and additional policy development.

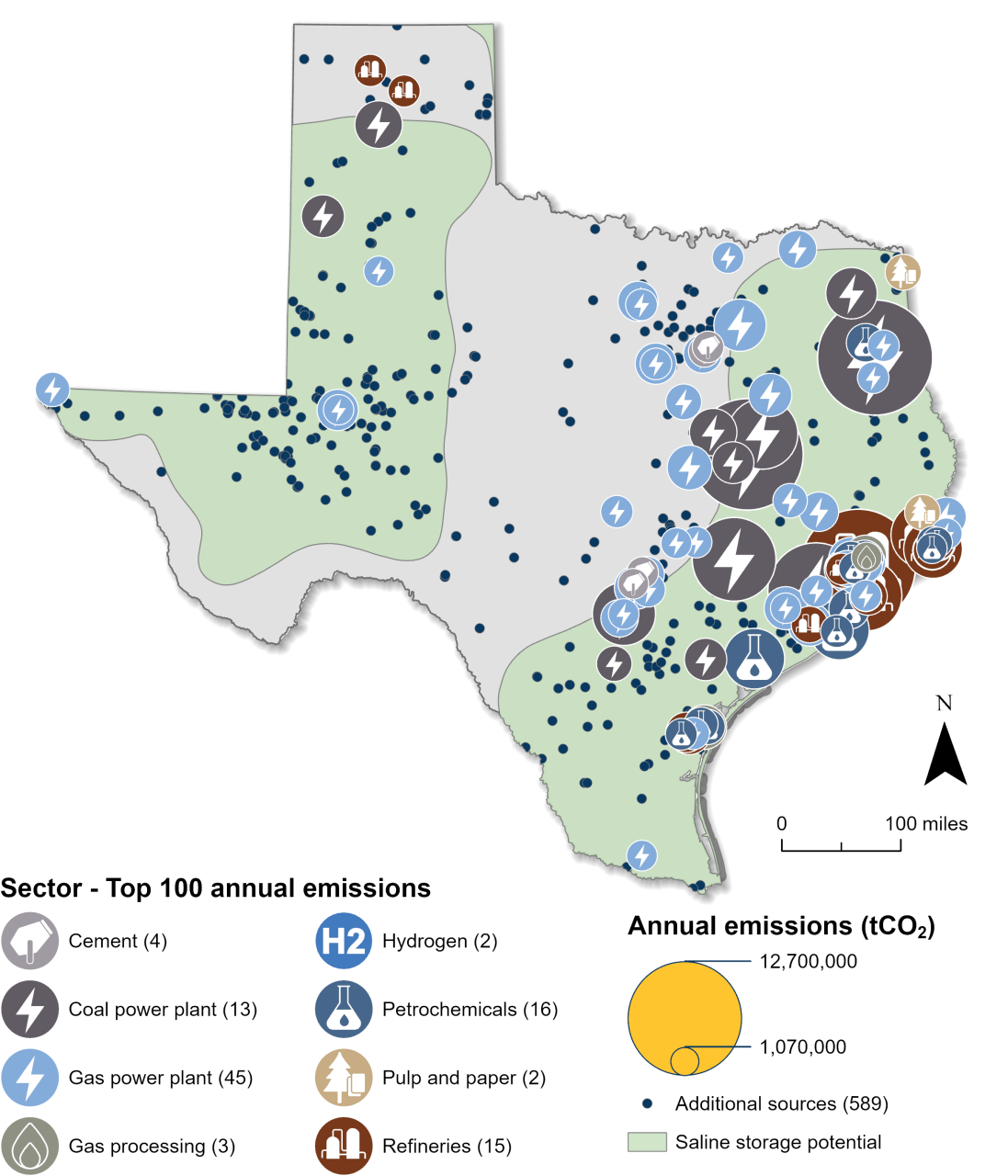

Industrial and Power Facilities in Texas

Of the state’s 850 industrial and power facilities, 693 are eligible for the federal 45Q tax credit. A plurality of these facilities are gas power plants, at 116, which emit over 111 million metric tons of CO2 annually. The state also has a high proportion of gas processing facilities, chemicals facilities, petrochemicals facilities, and a wide range of other industrial facilities. The second highest emitter in the state is coal power, with 13 plants and annual emissions of over 76 million metrics tons of CO2. In total, all 693 qualifying facilities represent 99 percent of total annual CO2 emissions in the state.

Texas also has ideal geology for geologic CO2 storage and is currently in the application process for Class VI primacy, which would give the state primary permitting authority over geologic CO2 storage wells. The state’s storage capacity is primarily split between the Permian Basin in the western part of the state and along the Gulf Coast in the east, positioning Texas as a key location for CO2 storage projects in the region.

While Texas is seeking primacy, the US Environmental Protection Agency (EPA) recently approved Texas’ first Class VI injection well permits, allowing Oxy Low Carbon Ventures to construct three CO2 storage wells in Ector County in the Permian Basin, associated with its Stratos direct air capture facility. As of May 2025, there are 17 Class VI projects in the state with 54 well applications under review by EPA. In addition to onshore CO2 storage, the state is taking action to utilize its offshore CO2 storage potential.

Multiple carbon storage hubs are planned within the state, with various project developers taking the lead in these initiatives. Among these is the South Texas DAC hub, a direct air capture and storage hub projected to hold up to one billion metric tons of CO2 safely and securely deep underground. Another carbon storage hub in the state is planned to span 10,000 acres across West Texas with a storage capacity of 30 million metric tons of carbon dioxide.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

The legislative landscape for carbon management has evolved significantly in Texas, driven by the state’s history in the oil and gas sector. The state has enacted legislation related to onshore and offshore storage, long-term risk management of stored CO2, and tax incentives for carbon management:

- HB 1796, 2009: Focused on long-term liability and the transfer of ownership for offshore storage sites. It established a storage fund for offshore locations, where the operator bears responsibility for monitoring and verification until the state assumes liability upon well closure. The Texas School Land Board was granted authority to use the newly created Texas Emissions Reduction Plan Fund, particularly for overseeing offshore sites.

- SB 1387, 2009: Concentrated on onshore storage sites, creating the anthropogenic carbon dioxide storage trust fund. It directed the Texas Railroad Commission to formulate rules for geologic storage, defining that the project operator owns the CO2 until liability is transferred to the state. Mineral rights were established to have primacy in this framework.

- HB 469, 2009: Provided tax incentives for specific carbon capture projects.

- HB 1284, 2022: Granted the Texas Railroad Commission sole jurisdiction over carbon storage wells and mandated the Commission to seek primacy. Texas is preparing its application while consulting with the Environmental Protection Agency (EPA). The ongoing collaboration with the EPA underscores the state’s commitment to align its regulations with federal standards, ensuring a comprehensive and effective framework for carbon capture within the dynamic energy landscape of Texas.

As of May 2025, the Texas state legislature had introduced several additional pieces of legislation related to carbon management that are moving through the legislative process. To see real-time updates on this legislation, view our State Legislative Tracker.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Texas. The darker bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Texas is listed for each industry in million metric tons.

Source: EPA GHGRP, 2024.

Last updated: May 2025