South Dakota Carbon Capture Opportunities

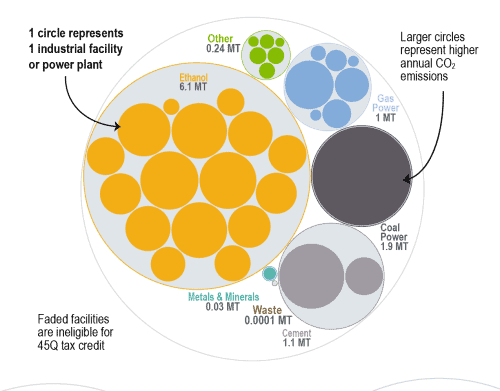

South Dakota has 32 facilities that qualify for the federal 45Q tax credit, primarily in the ethanol and gas power sectors. Together, these facilities emit 10.3 million metric tons of CO2 annually, which represents 99 percent of South Dakota’s total CO2 emissions. South Dakota is also the fourth-largest ethanol-producing state in the nation and holds immense potential for implementing carbon capture technology, especially for this sector.

Although the state has not enacted comprehensive carbon capture legislation, private sector is taking an active role in advancing carbon management deployment.

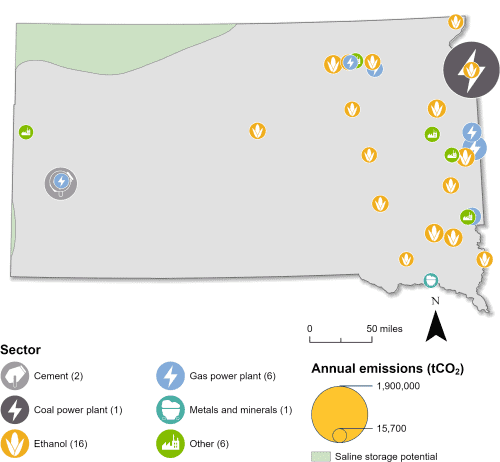

Industrial and Power Facilities in South Dakota

South Dakota has 32 facilities that qualify for the 45Q tax credit, including 16 ethanol facilities. In 2022, the state produced over eight percent of the nation’s ethanol fuel and currently ranks fourth in ethanol production, a sector that contributed an estimated $590 million to South Dakota’s economy in 2021. These 16 ethanol facilities emit roughly 6 million metric tons of CO2 emissions annually, representing 58 percent of CO2 emissions in the state.

In addition to ethanol, one coal power plant, two cement plants, six gas power plants, and seven other facilities qualify for the 45Q tax credit. The state’s 45Q-eligible facilities emit 10.3 million metric tons of CO2 annually, representing 99 percent of the state’s total CO2 emissions. If retrofitted with carbon capture, these facilities could help South Dakota significantly reduce its total CO2 emissions.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Beyond capture, South Dakota has modest potential for permanent storage of CO2 in saline geologic formations. Additionally, the state’s proximity to North Dakota, which has much higher potential for CO2 storage in saline geologic formations, makes South Dakota well-positioned as a corridor for transporting CO2 regionally.

Legislative Context for Carbon Management

In 2009, HB 1129 authorized the South Dakota Public Utilities Commission to regulate the integrity of CO2 pipelines used for transporting CO2 for enhanced oil recovery or geologic storage. In 2022, HB 1120 allowed for the taxation of CO2 capture companies related to transporting CO2.

In 2024, South Dakota enacted SB 201 and HB 1186. These bills, which were positioned as a compromise between landowners and project developers, weakened local permitting authority but gave counties the ability to charge pipeline operators a tax of $1 per linear foot of pipe installed. They also included a “landowner bill of rights”, which codified protections like ensuring pipeline developers are liable for damages caused by a project and designating a minimum depth at which a pipeline must be buried. However, a successful citizen-led veto in November 2024 led to the repeal of this legislation.

In early 2025, South Dakota introduced several pieces of additional legislation to regulate carbon management in the state related to issues such as pipeline safety and eminent domain. On March 6, 2025, the state enacted HB 1052, which prohibits the use of eminent domain for the acquisition of right-of-way and for construction/operation of CO2 pipelines. There are several other pieces of carbon management legislation moving through the legislative process as of March 11, 2025. To see real-time updates on South Dakota’s active legislation, see our State Legislative Tracker.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in South Dakota. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in South Dakota is listed for each industry in million metric tons.

Source: EPA GHGRP, 2024.

Last updated: May 2025