Pennsylvania Carbon Capture Opportunities

Given the foundational role the power and industrial sectors play in Pennsylvania, the state recognizes the role that carbon management will have in furthering economic development while also reducing emissions. Of the state’s 280 industrial and power facilities, 221 are eligible for the 45Q federal tax credit. These facilities emit around 94 million metric tons of CO2 annually and represent 99 percent of Pennsylvania’s total annual CO2 emissions.

Over the last two decades, Pennsylvania has developed a supportive policy environment to encourage the deployment of carbon management. In 2024, Pennsylvania enacted SB 831, which addresses key issues related to CO2 storage and provides a strong regulatory framework for carbon management projects. The state is also actively pursuing Class VI primacy.

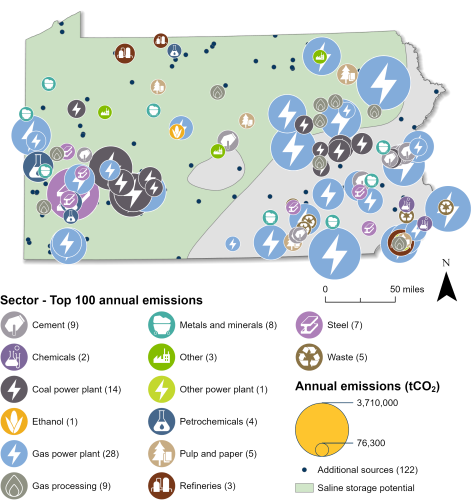

Industrial and Power Facilities in Pennsylvania

Pennsylvania has 221 facilities that are eligible for the 45Q tax credit. Its gas power plants are its highest emitters, 48 of which are 45Q-eligible. The state also has 50 gas processing plants, 23 steel plants, 18 metals and minerals facilities, 14 coal power plants, and 69 other facilities that are 45Q-eligible. In total, these 221 facilities emit approximately 94 million metric tons of CO2 annually, representing 99 percent of the state’s annual CO2 emissions.

Pennsylvania also has the potential to safely store CO2 underground in geologic formations. As such, Pennsylvania submitted a letter of intent to apply for funding under the US Environmental Protection Agency’s Underground Injection Control (UIC) Class VI grant program in 2023. This grant program was developed to help states prepare for Class VI primacy, which gives individual states primary permitting authority over their Class VI injection wells.

Pennsylvania is also involved in the Appalachian Hydrogen Hub (ARCH2) and the Mid-Atlantic Clean Hydrogen Hub (MACH2). Both hubs intend to use carbon capture and storage (CCS) to produce clean hydrogen, but CCS will play a more prominent role in ARCH2. Tenaska is also developing the Tri-State CCS Hub in Pennsylvania, Ohio, and West Virginia.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

The Pennsylvania General Assembly recognizes the critical role that carbon management will play in achieving its emissions goals while also creating and maintaining a strong economy. The Pennsylvania Climate Change Act of 2008 required a report considering the economic opportunities of carbon sequestration. Furthermore, Act 129 (2008) required a report on the potential for geologic carbon storage. These reports found favorable results for carbon capture and storage potential in the state. The reports leveraged partnerships such as the Midwest Regional Carbon Sequestration Partnership, for which Pennsylvania served as a contributing member for nearly two decades.

In June 2024, the Pennsylvania General Assembly passed SB 831. This legislation established a strong regulatory framework for carbon management projects by:

- Describing geologic CO2 storage as being in the public interest.

- Outlining the protocol for obtaining consent from property owners for the unitization of pore space within CO2 storage facilities, specifying that the operator must obtain at least 75 percent of the ownership interest in the pore space for the proposed storage facility.

- Authorizing the Secretary of Environmental Protection to set and collect fees associated with administrative hearings and other regulatory processes.

- Obliging operators to pay fees for CO2 injections, with proceeds directed to the Carbon Dioxide Storage Facility Fund for regulatory purposes.

- Authorizing the Department of Environmental Protection to issue a certificate of project completion 10 years after CO2 injection ends, allowing time for monitoring and impact assessment. During this period, the facility must be actively monitored and managed. Afterward, except for criminal or contractual liability, Pennsylvania assumes primary responsibility and liability for the stored CO2.

As of early June 2025, Pennsylvania had two bills moving through the legislative process with provisions related to carbon management. To see the status of active legislation in Pennsylvania, view our State Legislative Tracker.

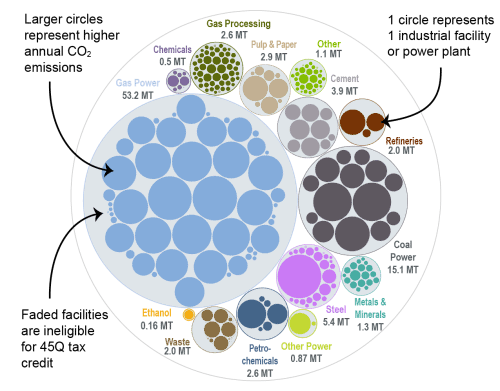

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Pennsylvania. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Pennsylvania is listed for each industry in million metric tons.

Source: EPA GHGRP, 2024.

Last updated: June 2025