Oklahoma Carbon Capture Opportunities

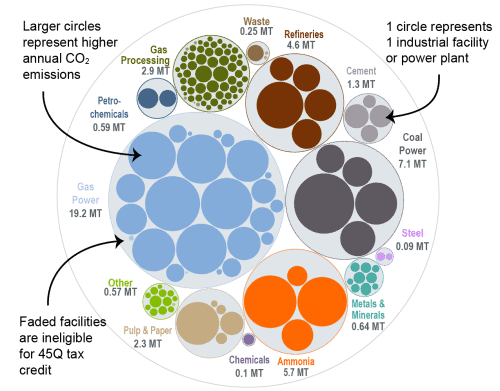

Carbon capture can lower emissions across a variety of sectors in Oklahoma and bring jobs and private investment to the state. Of the 160 industrial and power facilities in the state, 128 are eligible for the 45Q federal tax credit. These 128 facilities emit around 45 million metric tons of carbon dioxide (CO2) annually, representing 99 percent of total annual CO2 emissions in the state.

Oklahoma has legislatively supported carbon management since 2009 and has continued enacting supportive policies since. Additionally, the state is actively pursuing Class VI primacy.

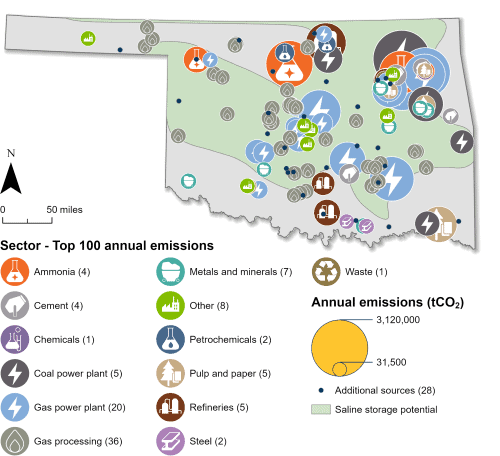

Industrial and Power Facilities in Oklahoma

Oklahoma has 128 facilities that are eligible for the 45Q tax credit. The state’s 23 gas power plants are its highest emitters, 22 of which are 45Q-eligible. Oklahoma also has 56 gas processing plants, nine metals and minerals facilities, five refineries, five coal power plants, two steel plants, and 29 other facilities that are eligible for 45Q. In total, all 128 eligible facilities emit approximately 45 million metric tons of CO2 annually, representing 99 percent of the state’s annual CO2 emissions.

Oklahoma can safely store captured CO2 underground in geologic formations and was one of the first states to do so in oil fields, starting in 1982. Additionally, Oklahoma submitted a letter of intent to apply for funding under the US Environmental Protection Agency’s (EPA) Underground Injection Control (UIC) Class VI grant program in 2023. This grant program was developed to help states prepare for Class VI primacy, which gives individual states primary permitting authority over their Class VI injection wells.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Oklahoma has provided policy support for carbon capture for over a decade. The Carbon Capture and Geologic Sequestration Act (SB 610, 2009) sets out key principles on the regulation of CO2 storage, including permitting, property, and resource rights, and the respective jurisdictions and powers of the Corporation Commission and Department of Environmental Quality.

Additionally, former Governor Mary Fallin supported carbon management efforts by joining the Governors’ Partnership for Carbon Capture in 2018. The Partnership was a bipartisan group of governors that provided a state voice for mutual carbon capture policy and deployment priorities.

More recently, Oklahoma enacted several pieces of carbon management-related legislation in 2023 and 2024:

- SB 200 (2023): Required the Corporation Commission and Department of Environmental Quality to evaluate their regulatory and statutory frameworks for compliance with the federal Safe Drinking Water Act, identify needed changes, and report findings to the Secretary of Energy and Environment to support development of Underground Injection Control Class VI wells.

- SB 19 (2023): Required energy from biomass, including bagasse, to be classified as renewable and carbon-neutral. It is considered carbon negative when CO2 is captured.

- HB 4095 (2024): Amends the Oklahoma Underground Facilities Act, which designates CO2 pipelines as an “underground facility” and clarifies that pipelines can be located in a public or private easement or right-of-way.

In 2025, the state passed a carbon management-related bill to expand Oklahoma’s carbon storage framework and set the stage for eventual Class VI primacy. SB 269 addresses jurisdiction and management over storage facilities, public notice requirements, and state funding structures to support CO2 storage activities.

To see details on this and other legislation, view our State Legislative Tracker.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Oklahoma. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Oklahoma is listed for each industry in million metric tons.

Source: EPA GHGRP, 2024.

Last updated: June 2025