Nebraska Carbon Capture Opportunities

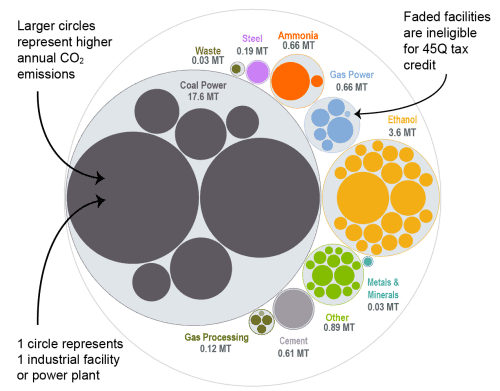

Carbon management can lower emissions across a variety of sectors in Nebraska and bring jobs and private investment to the state. Of the 73 industrial and power facilities in the state, 57 are eligible for the 45Q federal tax credit. These 57 facilities emit around 24 million metric tons of carbon dioxide (CO2) annually, representing 99 percent of total annual CO2 emissions in Nebraska.

Nebraska has not yet established comprehensive carbon management legislation. As such, expanding the legislative and regulatory framework through the enactment of supportive policies can create greater clarity and stability for carbon management deployment in the state.

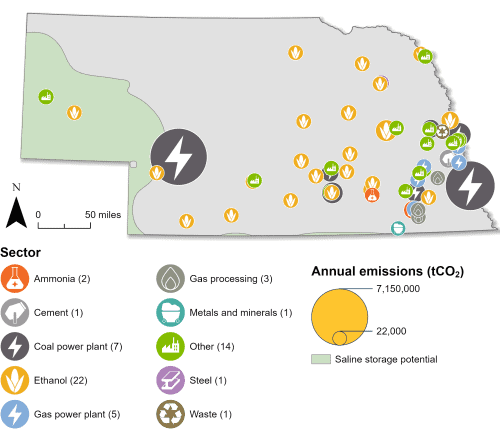

Industrial and Power Facilities in Nebraska

Carbon management could play an important role in lowering emissions from Nebraska’s industrial and power sectors, with 57 facilities that are 45Q-eligible. As one of the largest ethanol producers in the country, the state is uniquely positioned to be a leader in decarbonizing the ethanol industry. All 22 of its ethanol facilities are 45Q-eligible, some of which are already taking advantage of carbon management technologies. In March 2025, ethanol producer Green Plains Inc. announced that the construction of carbon capture infrastructure had commenced at its Nebraska plants as a part of the Trailblazer CCS Project.

In addition to ethanol, the state has seven coal plants, five gas power plants, three gas processing plants, two ammonia facilities, and 18 other facilities that are 45Q-eligible. In total, emissions from all 57 eligible facilities represent 99 percent of Nebraska’s total annual CO2 emissions.

Beyond capture, Nebraska may have some potential to store CO2 underground in geologic formations. As of June 2025, Nebraska had two Class VI permits under review by the EPA. Additionally, Nebraska is well-positioned as a corridor for transporting CO2 regionally

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Nebraska has not yet established comprehensive carbon management legislation and would benefit from doing so, given the growing interest in carbon management in the state. However, the Nebraska State Legislature has passed some carbon management related legislation.

Most recently, the state passed LB 937 in 2024, which created a Sustainable Aviation Fuel Tax Credit and included carbon capture and storage as a method by which producers can meet the required emissions reductions.

Alongside private investment by carbon management developers in Nebraska, this legislation signals potential interest in developing additional supportive policies and a more robust regulatory framework for deployment.

To see legislative updates from states across the US, see our State Legislative Tracker.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Nebraska. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Nebraska is listed for each industry.

Source: EPA GHGRP, 2024.

Last updated: June 2025