Montana Carbon Capture Opportunities

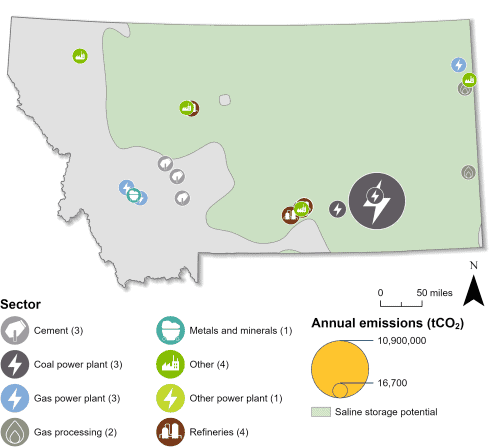

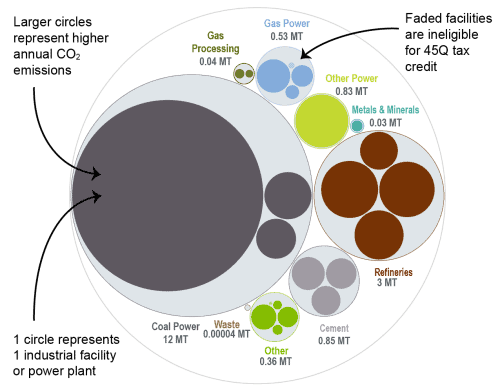

Carbon capture can lower emissions across a variety of sectors in Montana and bring jobs and private investment to the state. Of the 28 industrial and power facilities in the state, 21 are eligible for the 45Q federal tax credit. These 21 facilities emit around 18 million metric tons of carbon dioxide (CO2) annually, representing 99 percent of total annual CO2 emissions in the state.

Montana has legislatively supported carbon management since 2009 with the passage of SB 498, defining several key issues, including pore space ownership, long-term liability and management, unitization, and primacy. Additionally, former Governor Steve Bullock was a strong proponent of carbon management and a founding member of the State Carbon Capture Work Group and the Regional Carbon Capture Deployment Initiative, both convened by GPI.

Industrial and Power Facilities in Montana

Twenty-one of Montana’s 28 industrial and power facilities (or 75 percent of facilities) are eligible for 45Q. As such, the state has significant potential to lower its total emissions with carbon management technologies. The state’s three coal power plants, which account for the highest proportion of CO2 emissions, are all 45Q-eligible. Additionally, Montana has four refineries, three cement facilities, three gas power plants, two gas processing plants, and six other eligible facilities. In total, emissions from these 21 eligible facilities represent 99 percent of the state’s total annual CO2 emissions.

Additionally, Montana has the potential to safely store captured CO2 underground in geologic formations and is a part of the Big Sky Carbon Sequestration Partnership (BSCSP), encompassing South Dakota, Wyoming, Montana, Idaho, Oregon, and eastern Washington. Supported by the US Department of Energy and housed within the Montana State University’s Energy Research Institute, the Partnership aims to increase regional collaboration to deploy carbon management technologies. Montana’s Kevin Dome project was one of several BSCSP projects studying CO2 storage.

Montana also submitted a letter of intent to apply for funding under the US Environmental Protection Agency’s (EPA) Underground Injection Control (UIC) Class VI grant program in 2023. This grant program was developed to help states prepare for Class VI primacy, which gives individual states primary permitting authority over their Class VI injection wells.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Montana has a solid foundation for carbon management in the state. In 2009, the state passed SB 498, defining several key issues. It solidifies the surface owner owns the pore space and gives mineral rights primacy over carbon storage. The law also clarifies the matter of unitization and states that 60 percent of pore space ownership must consent to the carbon storage project. It further states that the operator is liable for the site, and they will pay a fee for each ton of injected CO2 which will be put into a fund for the long-term monitoring and management of the site. Thirty years after completing a project, the state can assume liability for the site. To further incentivize carbon capture in the state, new coal plants must capture at least 50 percent of their carbon emissions, and carbon capture equipment may be eligible for property tax abatements. Additionally, in Montana’s 2020 climate plan, carbon capture and storage (CCS) technology was framed as an emissions reduction solution for the power and industrial sector.

In 2025, the Montana State Legislature passed a resolution urging the federal government to repeal EPA regulations mandating CCS on fossil fuel power plants, potentially signaling a less supportive legislative environment in the state at present.

To see more details on this and other legislation, view our State Legislative Tracker.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Montana. The darker, larger bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Montana is listed for each industry.

Sources: EPA GHGRP, 2024. Bauer et al.

Last updated: June, 2025