Maryland Carbon Capture Opportunities

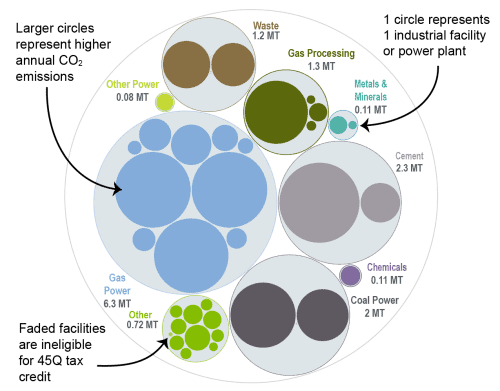

Carbon management could play a key role in Maryland’s emissions reduction efforts and clean energy goals. Of the 52 industrial and power facilities in the state, 33 are eligible for the 45Q federal tax credit. The state’s gas power sector could see the most significant reductions, as all of Maryland’s 10 gas plants are 45Q-eligible. In total, all 33 of the state’s 45Q-eligible facilities emit around 13 million metric tons of carbon dioxide (CO2) annually, representing 99 percent of total annual CO2 emissions in the state.

Maryland has set meaningful clean energy targets and has passed some legislation incentivizing carbon management in the state. To further support deployment, the state could benefit from passing additional legislation and establishing a more supportive regulatory framework.

Industrial and Power Facilities in Maryland

Maryland has 52 industrial and power facilities, 33 of which are eligible for the 45Q federal tax credit. The state’s highest emitting sector is gas power, with 10 total facilities, all of which are 45Q-eligible. One coal power plant is also eligible, along with four gas processing plants, two cement facilities, one chemicals facility, and 15 other facilities. In total, these 33 facilities emit around 13 million metric tons of CO2 annually, representing 99 percent of Maryland’s overall annual CO2 emissions.

Maryland also has some potential for geologic CO2 storage and is a member of the Midwest Regional Carbon Initiative (MRCI) through the Maryland Geological Survey. MRCI is a coalition of partners from research, academia, industry, NGOs, and the US government dedicated to the study and deployment of carbon capture, utilization, and storage in the Midwest, Northeast, and Mid-Atlantic regions.

Additionally, Maryland’s proximity to other Mid-Atlantic states with a heavy industry presence makes the state well-positioned as a corridor for transporting CO2 regionally.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Maryland has committed to meaningful emission reduction goals through legislation such as the Greenhouse Gas Emissions Reduction Act, which requires a statewide reduction of greenhouse gas emissions by 40 percent from 2006 levels by 2030. During his term, Former Governor Larry Hogan embraced the Clean and Renewable Energy Standard (CARES) Act, which includes incentives for carbon capture development in the state. The CARES legislation expands the eligibility of clean energy credits and plans to deliver 100 percent clean electricity by 2040 – increasing previous renewable portfolio goals. With this legislation, Maryland has the opportunity to take strong environmental leadership while creating jobs and economic growth with clean energy technologies such as carbon capture.

In 2022, the Maryland House of Representatives introduced a bill (HB 1366) addressing some of the key regulatory issues in carbon management like pore space ownership and long-term liability, but the bill died in committee.

Maryland enacted SB 0960 in 2024, which established the Climate Technology Founder’s Fund to provide early-stage funding for start-ups focused on climate technologies, including carbon capture, utilization, and storage, with a strong emphasis on equity by prioritizing small, minority, women-owned, and veteran-owned businesses. The fund aims to accelerate innovation and commercialization of carbon management solutions while aligning with Maryland’s broader climate and energy goals.

In 2025, Maryland enacted a carbon management-related bill that directed the Public Service Commission to solicit and approve proposals for dispatchable energy generation and large capacity energy resources. Carbon capture plays a role in the bill’s strategy for managing emissions sources from dispatchable sources, such as natural gas-fired power plants. To see more details of this legislation, visit our State Legislative Tracker.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Maryland. The darker, larger bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Maryland is listed for each industry in million metric tons.

Source: EPA GHGRP, 2024.

Last updated: May 2025