Kentucky Carbon Capture Opportunities

Carbon capture can lower emissions across a variety of sectors present in Kentucky and bring jobs and private investment to the state. With both geological research and state-level policy initiatives on carbon management, Kentucky is taking steps to adopt these decarbonization technologies on a larger scale and advance innovation.

Of the 134 industrial and power facilities in Kentucky, 95 are eligible for the 45Q tax credit. Together, these 95 facilities emit over 63 million metric tons of CO2 annually, representing 99 percent of the state’s total annual CO2 emissions.

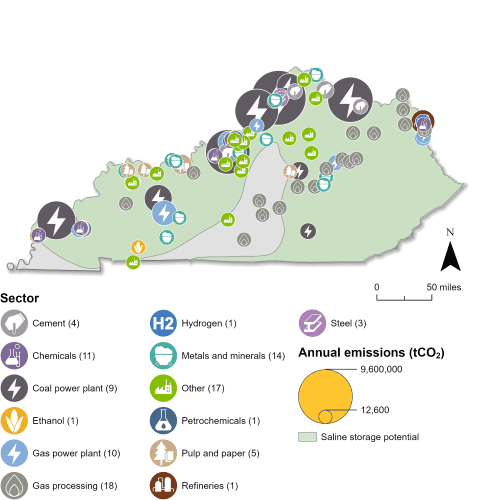

Industrial and Power Facilities in Kentucky

Kentucky has high potential for future carbon management deployment with 95 industrial and power facilities that qualify for the 45Q tax credit. These 95 facilities emit over 63 million metric tons of CO2 annually, representing 99 percent of the state’s total annual CO2 emissions. There are 18 gas processing facilities, 11 chemical plants, 10 gas power plants, nine coal power plants, and 47 other industrial facilities that are 45Q-eligible. Kentucky’s nine coal plants, all of which are 45Q-eligible, are the state’s highest emitters, representing around 69 percent of the state’s total annual CO2 emissions.

Kentucky is within the footprint of the Midwest Regional Carbon Sequestration Partnership (MRCSP), which covered 10 states and included numerous universities, state geological surveys, research institutions, and industry representatives. The MRCSP carried out field tests of carbon capture, conducted regional mapping, and participated in stakeholder outreach. The MRCSP states were folded into the Midwest Regional Carbon Initiative (MRCI) several years ago, which has since carried out additional research.

The largest saline reservoir for CO2 storage in the region is Mt. Simon Sandstone which spans Michigan, Ohio, Kentucky, and Indiana. This sink could be a cornerstone for the development of regional saline storage complexes.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Kentucky recognizes the critical role that carbon capture will play in achieving its emissions goals while creating and maintaining a strong economy. The state has begun to explore the feasibility of carbon management through legislation, and key issues such as pore space ownership and eminent domain are defined in state statute.

Anticipating requirements to mitigate CO2 emissions, the Kentucky Legislature passed HB 1 in 2007 to authorize funding for research by the Kentucky Geological Survey in the areas of CO2 enhanced oil recovery, CO2 enhanced gas recovery, and permanent geologic sequestration of CO2. House Bill 1 also encourages the Kentucky Geological Survey to partner with industry and share research costs which led to the formation of the Kentucky Consortium for Carbon Storage.

In 2011, Kentucky addressed eminent domain for CO2 transport projects through SB 50, which authorized the exercise of eminent domain authority for carbon dioxide pipelines. Also in 2011, HB 259 created a process for pooling pore space. If a storage operator makes good faith efforts and secures 51 percent of the interest in a pore space, the entire pore space can be pooled for CO2 storage. The stewardship of the stored CO2 will pass to the state or federal government after the facility is monitored for a duration of time by the project operator. HB 259 also made progress on inter-state collaboration. The bill contains a directive to work with other states on how to address CO2 migration, creating an avenue for future collaboration between states on CO2 storage.

In early 2025, Kentucky introduced a bill (HB 296) to establish a tax credit program that incentivizes the production of low-carbon jet fuel, for which carbon capture and storage (CCS) can be used as a method to lower the carbon intensity. To see real-time updates on Kentucky’s active legislation, see our State Legislative Tracker.

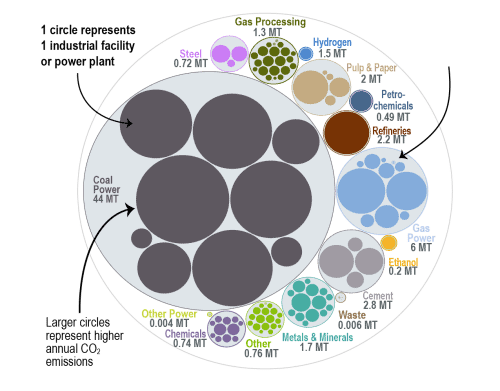

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Kentucky. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Kentucky is listed for each industry.

Source: EPA GHGRP, 2024.

Last updated: February, 2025