Illinois Carbon Capture Opportunities

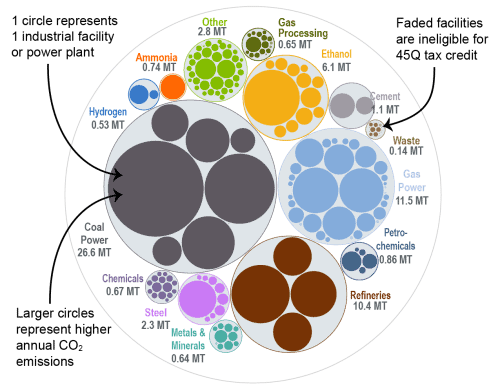

Carbon management is poised to play a key role in Illinois’ emissions reduction efforts and clean energy goals. Of the 213 industrial and power facilities in the state, 144 are eligible for the 45Q federal tax credit. Most of the state’s gas and coal power plants are 45Q-eligible, and these plants alone represent nearly 60 percent of the state’s total annual carbon dioxide (CO2) emissions. Illinois’ other key industrial sectors, including steel and ethanol production, also present significant potential for emissions reductions through carbon management. Collectively, all 144 eligible facilities in Illinois emit nearly 65 million metric tons of CO2 annually, representing 99 percent of total annual CO2 emissions in the state.

Illinois has taken significant steps in recent years to capitalize on its potential for carbon management. The state has passed several consequential bills in recent sessions that will impact deployment, and the enactment of additional key state policies could further accelerate this momentum.

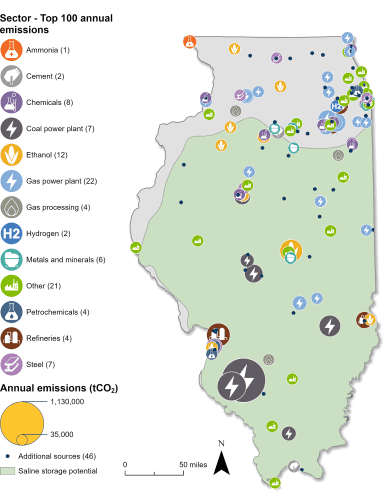

Industrial and Power Facilities in Illinois

Illinois has 213 industrial and power facilities, 144 of which are eligible for the 45Q tax credit. The plurality of these are gas power plants with 25 facilities, but the state’s highest emitters are its eight coal power plants, seven of which are 45Q-eligible (coal plants that are slated for imminent retirement are not included in these figures). Combined, emissions from just the state’s eligible power plants represent nearly 60 percent of the state’s total annual CO2 emissions.

Illinois also has 15 chemicals facilities, 13 gas processing plants, 12 ethanol plants, nine steel plants, five petrochemical facilities, and 67 other facilities that are 45Q-eligible. In total, these 144 industrial and power facilities emit approximately 65 million metric tons of CO2 annually, representing 99 percent of the state’s annual CO2 emissions.

Beyond capture, Illinois has significant potential to safely store CO2 underground in geologic formations across the state, specifically in the Mount Simon Sandstone formation. Currently, Illinois has 23 active Class VI applications with the US Environmental Protection Agency (EPA). Additionally, Archer Daniels Midland (ADM) was the first company granted a Class VI permit by the EPA. Their project in Decatur, Illinois has stored 4.5 million metric tons of CO2 from ADM’s nearby corn processing plants. On October 1, 2024, ADM notified the public that CO2 had migrated outside its target formation in one of its monitoring wells in Decatur, Illinois. Since July 2024, ADM has been working with EPA to address issues with deep monitoring wells approximately 5,000 feet underground. While this CO2 migration had no impact on surface or groundwater or risk to public health, CO2 injections have been paused during diagnostic testing. The EPA has since supported ADM’s proposed plan to modify its monitoring infrastructure, and remedial actions are now underway.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Illinois has enacted several consequential pieces of legislation in recent sessions related to carbon management and its role in the state’s clean energy goals. This includes:

- The Climate and Equitable Jobs Act of 2021: Puts Illinois on the path to 100% clean energy by 2050. The act requires private coal and natural gas generating units to reach zero emissions by 2030 and 2045 respectively. In particular, the act creates the Nonprofit Electric Generation Task Force to explore carbon capture and storage options for the Prairie State coal powered facility.

- Public Act 102-0341: Required the completion of a study by the Prairie Research Institute to look at the potential for carbon management technologies as well as recommendations for policy and regulatory needs. This study was completed in 2022.

- SB 3441 – Safety Moratorium on Carbon Dioxide Pipelines Act: Imposed a moratorium on CO2 pipelines until July 2026, or until the US Pipeline and Hazardous Materials Administration (PHMSA) finalizes updated regulations. Also included in the legislation is a requirement that CO2 pipeline operators use advanced computer modeling to predict the movement and dispersal of CO2 in the event of a leak and provide those results to the state, after which they will be publicly available on a website.

Illinois had several bills moving through the legislative process as of early May 2025. These bills relate to issues such as CO2 storage activities near sole source aquifers, the creation of a Carbon Dioxide Pipeline Fund, and modification of the existing CO2 pipeline legislation, which would allow CO2 pipeline projects to proceed after July 2026, even without updated PHMSA regulations. To see real-time updates on Illinois’ active carbon management legislation, view our State Legislative Tracker.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Illinois. The darker bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Illinois is listed for each industry in million metric tons.

Source: EPA GHGRP, 2024.

Last updated: May, 2025