Colorado Carbon Capture Opportunities

Carbon management will play a key role in Colorado’s emissions reduction efforts and clean energy goals. Of the 116 industrial and power facilities in the state, 86 are eligible for the 45Q federal tax credit. The state’s power sector is its top emitter, accounting for around 78 percent of the state’s total annual CO2 emissions, and all but one of its gas and coal power plants are eligible for 45Q. Colorado’s other key industrial sectors, including cement and ethanol production, also present significant potential for emissions reductions through carbon management. Collectively, all 86 eligible facilities emit nearly 36 million metric tons of carbon dioxide (CO2) annually, representing 99 percent of total annual CO2 emissions in the state

Colorado has taken significant steps over the past four years to capitalize on its potential for carbon management and build out a supportive regulatory framework. As such, the state is emerging as a leader in carbon management deployment in the US. In addition to enacting comprehensive carbon management legislation, the state recently published a Carbon Management Roadmap. GPI was a partner in this work.

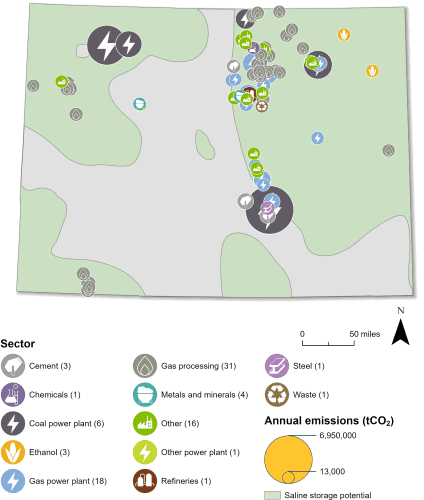

Industrial and Power Facilities in Colorado

Colorado has 116 industrial and power facilities, 86 of which are eligible for the 45Q tax credit. The plurality of these are gas processing plants with 31 facilities, but the state’s highest emitters are its coal power plants, which account for approximately 55 percent of the state’s total annual CO2 emissions. Colorado also has 18 gas power plants that are 45Q-eligible. Together with coal power, these two sectors represent 78 percent of Colorado’s total annual CO2 emissions.

The state also has three cement facilities, three ethanol plants, four metals and minerals facilities, and 21 other facilities that are 45Q-eligible. In total, all 86 eligible facilities emit nearly 36 million metric tons of CO2 annually, representing 99 percent of the state’s annual CO2 emissions.

Beyond capture, Colorado also has the potential to safely store captured CO2 underground in geologic formations across the state. Currently, Colorado has two active Class VI applications with the US Environmental Protection Agency, and the state is actively pursuing Class VI primacy.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Colorado has enacted several important pieces of carbon management legislation and has positioned itself well for deployment. This legislation includes:

- SB23-016: Grants the Energy and Carbon Management Commission (ECMC) authority over Class VI injection wells and authorizes ECMC to seek Class VI primacy over geologic CO2 storage. Requires that Class VI applicants conduct a cumulative impact analysis if the project could affect a disproportionately impacted community. Clarifies that a Class VI injection well shall not be located within two thousand feet of a residence, school, or commercial building.

- HB23-1074: Directed the Office of Just Transition to study workforce transitions, including shifts from fossil fuels to CCUS sectors.

- HB23-1210: Authorized the state to develop a Carbon Management Roadmap in collaboration with contractors. Expanded eligibility for carbon management projects under the Industrial and Manufacturing Operations Clean Air Grant Program.

- HB23-285: Directed ECMC to develop a report on intrastate pipeline siting and safety.

- HB24-1346: Clarifies pore space ownership, permits ECMC to approve geologic storage unitization, allows for local governments to seek technical assistance from ECMC related to siting and regulation of CO2 storage, and mandates accounting procedures for CO2 storage.

- HB23-1272: Established Colorado Industrial Tax Credit Offering (CITCO) to support decarbonization efforts.

Several pieces of carbon management legislation were introduced in the Colorado General Assembly during the 2025 legislative session. This included a bill establishing the Geologic Storage Stewardship Enterprise Fund to oversee long-term stewardship of CO2 storage facilities and a bill managing the flow of oil and gas severance tax revenue between two Colorado state funds: the Decarbonization Tax Credits Administration Cash Fund and the Energy and Carbon Management Cash Fund. Both bills were enacted in May 2025.

See our State Legislative Tracker for details on this and other legislation.

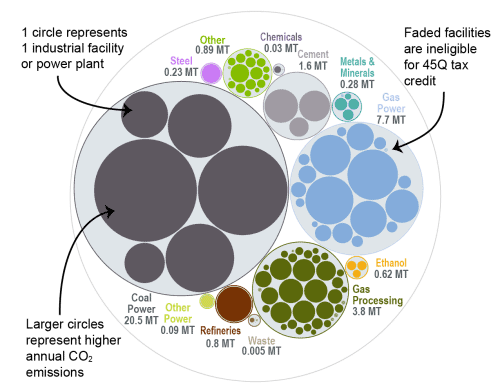

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Colorado. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Colorado is listed for each industry in million metric tons.

Source: EPA GHGRP, 2024.

Last updated: June 2025