Arkansas Carbon Capture Opportunities

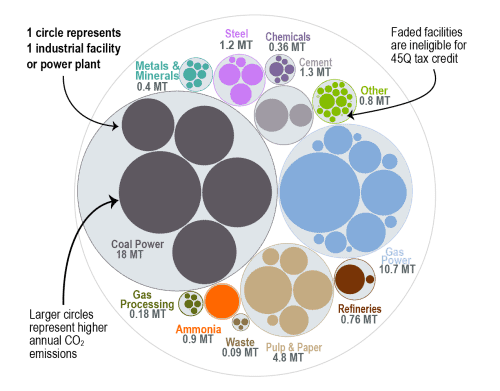

Arkansas holds significant potential for carbon management technologies in both the power and industrial sectors. Of the state’s 95 power and industrial facilities, 69 are eligible for the 45Q tax credit. These facilities emit 39 million metric tons of CO2 annually, representing 99 percent of the state’s total CO2 emissions.

From early engagements in US Department of Energy (DOE) funded initiatives to recent expansions in legislation, Arkansas is increasing its participation in carbon management initiatives. The state has passed supportive legislation and is well-positioned to pass more comprehensive carbon management legislation. Additionally, the private sector is taking an active role in advancing carbon capture and storage technology.

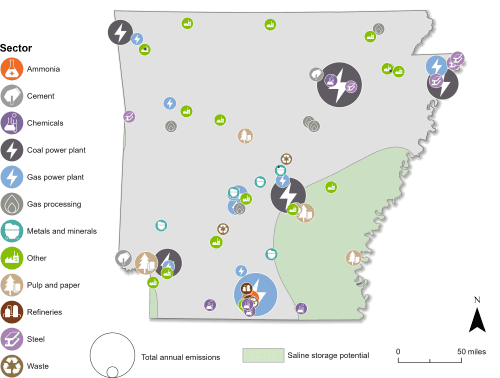

Industrial and Power Facilities in Arkansas

Arkansas demonstrates significant potential for CO2 capture from its industrial and power facilities, with 69 eligible for the 45Q tax credit. The map below shows where these facilities are located, and the amount of emissions from each. Among these are five coal power plants, 12 gas power plants, five gas processing plants, two refineries, two cement facilities, five steel facilities, and 38 other industrial facilities. These facilities emit 39 million metric tons of CO2 annually, representing 99 percent of the state’s total CO2 emissions. If retrofitted with carbon capture, these facilities could significantly reduce the state’s total CO2 emissions. Project developers are capitalizing on this opportunity, with a number of announced projects in the state.

Arkansas also has the potential to safely store captured CO2 underground in geologic formations, primarily in the southeastern part of the state. Currently, Arkansas has two active Class VI well applications with the US Environmental Protection Agency.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Arkansas has a historical commitment to providing clean, reliable, and affordable energy and is taking action on carbon management. In the early 2000s, the Arkansas Oil and Gas Commission participated in the DOE-funded Southeast Regional Carbon Sequestration Partnership (SECARB) and the Interstate Oil and Gas Compact Commission’s (IOGCC) Phase II Carbon Capture and Geological Storage Regulatory Task Force. Additionally, the state was recently part of the HALO hub, a tri-state hydrogen hub that sought federal funding along with Louisiana and Oklahoma. While the HALO hub was not selected for funding by DOE, HALO hub members are exploring ways to leverage the partnerships that were established through this effort.

In 2023, Arkansas expanded an existing law that regulates the underground storage of natural gas to include carbon oxides and hydrogen. The state also passed a bill clarifying the definition of some energy produced with carbon capture technologies as “carbon-negative.” Further action, such as enacting comprehensive carbon management regulations on permitting, long-term risk management, and community engagement, would play a pivotal role in further propelling the deployment of these technologies in the state. Such legislation would align with the state’s commitment to clean energy and position Arkansas as a regional leader in carbon management.

In February 2025, Arkansas enacted HB 1411, which clarified the regulation of carbon capture and storage in Arkansas and established the Carbon Dioxide Storage Fund to support long-term monitoring and remediation of underground storage sites.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Arkansas. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Arkansas is listed for each industry.

Sources: EPA GHGRP, 2024. Bauer et al.

Last updated: February, 2025