Kansas Carbon Capture Opportunities

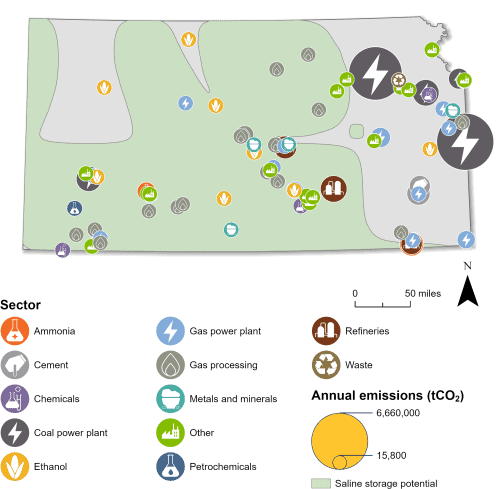

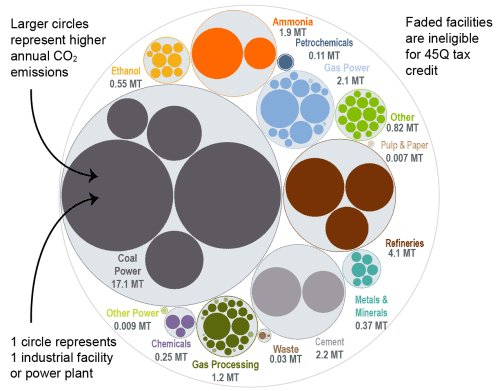

Carbon management technologies can lower emissions across a variety of sectors in Kansas and bring jobs and private investment to the state. Of the 105 industrial and power facilities in the state, 78 are eligible for the 45Q federal tax credit. The highest proportion of these facilities are gas processing plants, at 17, but Kansas’ highest emitting sector is coal power. In total, all 78 eligible facilities emit nearly 31 million metric tons of carbon dioxide (CO2) annually, representing 99 percent of total annual CO2 emissions in Kansas.

Kansas has enacted some supportive policies related to carbon management, and its legislature has recently signaled interest in further deployment. Additionally, the state has expressed interest in obtaining Class VI primacy from the US Environmental Protection Agency (EPA). Though the state has positioned itself as generally supportive of carbon management deployment, it could benefit from enacting additional supportive policies and creating a more robust regulatory framework.

Industrial and Power Facilities in Kansas

Kansas has 78 facilities that are eligible for the 45Q tax credit. The state’s highest emitting sectors are coal power, gas power, and cement manufacturing. All five of the state’s coal power plants are 45Q-eligible, along with 13 gas power plants and two cement facilities. Kansas also has nine ethanol plants, three chemical facilities, two ammonia facilities, and 27 additional 45Q-eligible facilities. In total, these 78 facilities emit nearly 31 million metric tons of CO2 annually, representing 99 percent of the state’s annual CO2 emissions.

In addition to CO2 capture, Kansas has significant capacity to safely store CO2 underground in geologic storage formations. In 2023, the state submitted a letter of intent to apply for funding under EPA’s Underground Injection Control (UIC) Class VI grant program. This grant program was developed to help states prepare for Class VI primacy, which gives individual states primary permitting authority over their Class VI injection wells. Though Kansas has signaled its intent to obtain Class VI primacy, the state currently has two active Class VI well applications with the EPA, both with ethanol producers.

Sources: EPA GHGRP, 2024. Bauer et al., NATCARB, 2018.

Legislative Context for Carbon Management

Kansas has passed some supportive policies related to carbon management. The Carbon Dioxide Reduction Act, enacted in 2007, sets property and income tax reductions for carbon dioxide capture, storage, or utilization and provides for the regulation of CO2 injection wells. In 2019, the Kansas State Corporation Commission also developed the Carbon Dioxide Injection Well and Underground Storage Fund to handle expenses related to permitting, monitoring, storage, and remediating adverse environmental impacts after injection. The law specifies that the state will not be held liable or financially responsible for any damages resulting from the leak or discharge of CO2 from any CO2 injection well or the underground storage of CO2.

In the 2025 legislative session, the Kansas legislature introduced SB 274, which would require the Kansas State Corporation Commission to conduct a technical and legal feasibility study on developing new nuclear energy generation in the state, including its potential ties to direct air capture. The legislature adjourned in early May 2025, and as of that time, SB 274 had not advanced beyond introduction.

To see real time updates on active state legislation, visit our State Legislative Tracker.

This bubble diagram shows the number of facilities and corresponding annual CO2 emissions for each industry in Kansas. The darker large bubbles are eligible for the 45Q carbon capture tax credit, while the faded bubbles are too small to be eligible. The total amount of CO2 emissions in Kansas is listed for each industry.

Source: EPA GHGRP, 2024.

Last updated: June 2025